Insurance Mohtasib / Ombudsman: Functions and Filing Complaints

In case you are wondering how to get claim from any insurance company in Pakistan. In case Jubilee insurance, State Life Insurance, Adam Jee Insurance or any other insurance company is trying to cheat. As Pakistani citizen you have right to take insurance companies to court. Their is a special court known as insurance mohatasib or insurance ombudsman in federal capital Islamabad and it has branches in every provincial capital as well. The process of filing complaint is very easy and simple. The case disposal or redressal of your grievances time is also very short as these ombudsman uses summary process to resolve matters.

Insurance Mohtasib/Ombudsman: Functions and Filing Complaints

In today’s complex world of insurance, understanding your rights and avenues for resolution is crucial. Whether you’ve faced claim denials, delayed payments, or disputes with your insurer, the Insurance Mohtasib/Ombudsman serves as a vital mediator. This article explores the functions of the Insurance Mohtasib/ Federal Insurance Ombudsman Pakistan and guides you through the process of filing complaints effectively.

What is an Insurance Mohtasib/Insurance Ombudsman Pakistan?

An Insurance Mohtasib or Insurance Ombudsman Pakistan is an independent and impartial authority appointed by the government or regulatory bodies in various countries. Their role is to resolve complaints and disputes between policyholders (consumers) and insurance companies. They ensure fair treatment and adherence to insurance laws and regulations by investigating complaints, mediating between parties, and facilitating resolutions that are fair and equitable. The Insurance Mohtasib/Insurance Ombudsman Pakistan typically handles issues such as claim denials, delays in processing claims, policy disputes, and other grievances related to insurance policies. They provide a formal avenue for policyholders to seek redressal without resorting to lengthy legal proceedings.

Importance of the Insurance Mohtasib/Insurance Ombudsman Pakistan

Here are some key reasons highlighting their importance:

- Consumer Protection: They act as an independent mediator to protect the rights of insurance consumers. Policyholders can approach them if they feel unfairly treated or have grievances against insurance companies.

- Dispute Resolution: They provide a mechanism for resolving disputes efficiently and impartially. This helps in avoiding lengthy legal battles and provides a faster resolution for policyholders.

- Transparency and Accountability: By overseeing insurance practices, they promote transparency in the insurance industry. This encourages insurance companies to adhere to ethical standards and comply with regulatory requirements.

- Education and Awareness: They educate consumers about their rights and responsibilities under insurance policies. This empowers policyholders to make informed decisions and enhances their understanding of insurance terms and conditions.

- Improving Insurance Practices: Through their recommendations and rulings, they contribute to improving insurance practices and policies. This benefits both consumers and insurance companies by fostering a fairer and more competitive insurance market.

- Regulatory Support: They complement regulatory bodies by addressing specific consumer complaints and issues that may not fall under general regulatory oversight.

In essence, the Insurance Mohtasib/Ombudsman plays a pivotal role in safeguarding consumer interests, promoting fairness, and maintaining trust in the insurance sector.

How does the Insurance Mohtasib or Insurance Ombudsman Pakistanhelp consumers?

Here are some ways they help consumers:

- Handling Complaints: They provide a platform for consumers to lodge complaints against insurance companies for issues like claim disputes, delays, unfair practices, etc.

- Mediation and Resolution: They mediate between consumers and insurance companies to resolve disputes amicably and fairly, aiming to achieve a satisfactory outcome for both parties.

- Investigation: They investigate complaints thoroughly, gathering necessary information from both sides to make informed decisions.

- Recommendations: Based on their investigations, they make recommendations for corrective actions to insurance companies to rectify any unfair treatment or mistakes.

- Promoting Fair Practices: They promote fair practices within the insurance industry by addressing systemic issues and encouraging compliance with regulations.

- Educating Consumers: They educate consumers about their rights and responsibilities regarding insurance policies and claims.

- Improving Transparency: By promoting transparency, they ensure that insurance policies are clear and understandable to consumers.

Overall, the Insurance Mohtasib/Ombudsman acts as a neutral third party to ensure that consumers are treated fairly and that insurance companies uphold their obligations responsibly.

When should you approach the Insurance Mohtasib/Insurance Ombudsman Pakistan?

You should approach the Insurance Mohtasib/Ombudsman when you have a complaint against an insurance company that hasn’t been resolved satisfactorily through their internal grievance handling process. Here are some common situations when you might consider approaching the Insurance Mohtasib/Ombudsman:

- Unresolved Complaints: If you’ve filed a complaint with your insurance company and they haven’t resolved it within a reasonable time frame or to your satisfaction.

- Claims Disputes: If you believe your insurance claim has been unfairly denied, delayed, or underpaid, and you’ve exhausted the insurer’s appeal process.

- Policy Issues: When there are disagreements or confusion regarding policy terms, coverage, premiums, or any other contractual matters.

- Service Issues: If you’ve faced poor customer service or unethical behavior from the insurance company.

- Non-disclosure or Misrepresentation: If you believe the insurer misrepresented information or didn’t disclose important details that affected your insurance coverage or claim.

Approaching the Insurance Mohtasib/Ombudsman typically comes after you’ve tried to resolve the issue directly with the insurance company and haven’t received a satisfactory resolution. They serve as an independent mediator to help resolve disputes between policyholders and insurers fairly.

Step-by-Step Guide to Filing a Complaint

Navigating the process

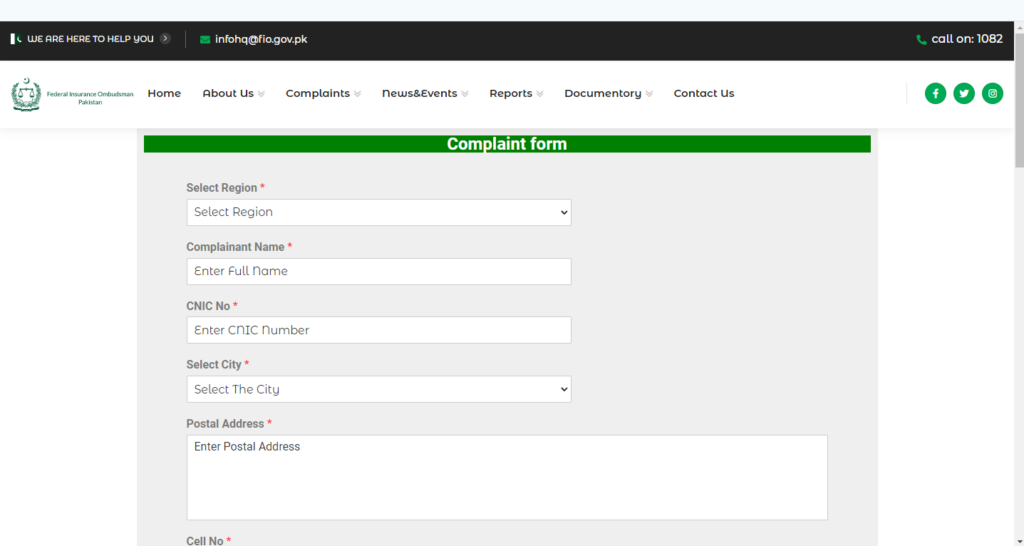

- Gather Documentation: Collect all relevant documents—policy details, correspondence, and evidence supporting your complaint.

- Contact the Ombudsman: Reach out to the Insurance Mohtasib/Ombudsman’s office. They often have online forms or helplines for initiating complaints.

- Submit Your Complaint: Fill out the complaint form accurately. Include concise details of your issue and attach supporting documents.

- Await Response: The Ombudsman will acknowledge receipt and begin the investigation process.

What happens after you file a complaint?

Understanding the next steps

Once your complaint is lodged, the Ombudsman will review the case impartially. They may seek additional information from both parties and propose recommendations for resolution.

Limitations and Scope of the Insurance Mohtasib/Ombudsman

Know the boundaries

While they strive for fair outcomes, certain cases involving legal complexities or matters outside their jurisdiction may be referred to the courts. Understanding these limitations helps manage expectations.

Differences between Insurance Mohtasib/Insurance Ombudsman Pakistanand Courts

Choosing the right path

Unlike courts, which involve formal legal proceedings, the Ombudsman offers a quicker, less adversarial route. They focus on mediation rather than litigation, promoting amicable resolutions.

Examples of Resolved Cases

Real-world success stories

From disputed claims to policy misinterpretations, numerous cases have been successfully resolved through the Ombudsman’s intervention. These examples highlight their effectiveness in achieving fair outcomes.

Tips for Effective Communication

Enhancing your interaction

- Be Clear and Concise: Articulate your concerns with clarity.

- Provide Evidence: Support your claims with documented proof.

- Stay Patient: Allow time for thorough investigation and resolution.

Conclusion

In conclusion, the Insurance Mohtasibc or Ombudsman plays a pivotal role in safeguarding consumer rights within the insurance sector. By offering a streamlined, impartial approach to dispute resolution, they ensure fairness and accountability. Whether you’re facing claim issues or policy disputes, understanding how to leverage their services can make a significant difference in achieving satisfactory outcomes.

FAQs about Insurance Mohtasib/Insurance Ombudsman Pakistan

1. What types of complaints can I file with the Insurance Mohtasib/Ombudsman? You can file complaints related to claim rejections, delayed payments, policy disputes, and issues of non-disclosure, among others.

2. Is there a cost associated with filing a complaint with the Insurance Mohtasib/Ombudsman? No, the services of the Insurance Mohtasib/Ombudsman are typically free of charge for consumers.

3. How long does it take for the Insurance Mohtasib/Ombudsman to resolve a complaint? Resolution times vary depending on the complexity of the case, but they aim to resolve complaints within a reasonable timeframe.

4. Can the Insurance Mohtasib/Ombudsman enforce decisions on insurance companies? Their recommendations are persuasive rather than binding, but insurers generally comply to maintain good standing.

5. What if I’m not satisfied with the Ombudsman’s decision? If you disagree with the outcome, you may still pursue legal avenues through the courts if necessary.

File Online Complaint in Federal Insurance Ombudsman by clicking below:

Useful Links:

Open Website https://fio.gov.pk/

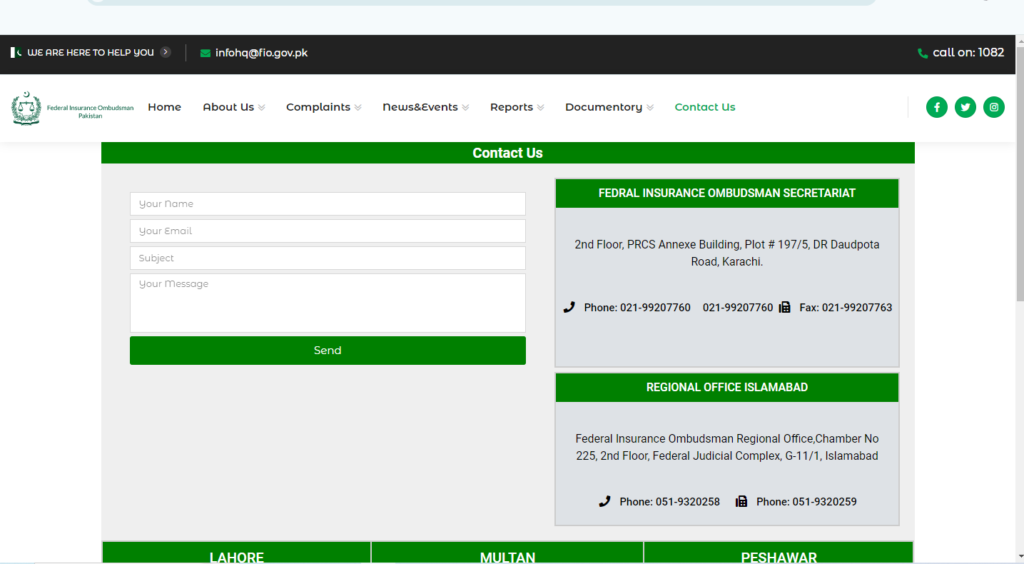

Contact: