Filing an income tax return in Pakistan can seem daunting, but it’s essential to stay compliant with the law and contribute to the nation’s development. Whether you’re a salaried individual, a business owner, or a freelancer, this guide will help you navigate the process of filing your income tax return in Pakistan.

1. Understanding the Basics of Income Tax in Pakistan

Before you dive into the filing process, it’s crucial to understand what income tax is and who needs to file a return.

1.1 What is Income Tax?

Income tax is a tax levied by the government on the income earned by individuals and businesses within Pakistan. The Federal Board of Revenue (FBR) is responsible for collecting income tax and ensuring compliance.

1.2 Who Needs to File an Income Tax Return?

In Pakistan, you need to file an income tax return if:

- Your annual income exceeds the taxable threshold.

- You own immovable property with a value of Rs. 5 million or more.

- You own a motor vehicle with an engine capacity above 1000cc.

- You have received foreign income.

- You are a non-resident Pakistani with taxable income in Pakistan.

2. Preparing to File Your Income Tax Return

Preparation is key to a smooth filing process. Here’s what you need to gather before you start:

2.1 Required Documents

- CNIC/NICOP: Your Computerized National Identity Card or National Identity Card for Overseas Pakistanis.

- Bank Statements: Statements from all your bank accounts for the relevant tax year.

- Income Statements: For salaried individuals, this includes salary slips; for businesses, this includes profit and loss statements.

- Tax Deduction Certificates: Certificates from your employer, bank, or any other institution that has deducted tax at the source.

- Utility Bills: If you claim expenses related to your business or employment.

2.2 Registering with FBR

To file your return, you must be registered with the FBR. If you haven’t registered yet, follow these steps:

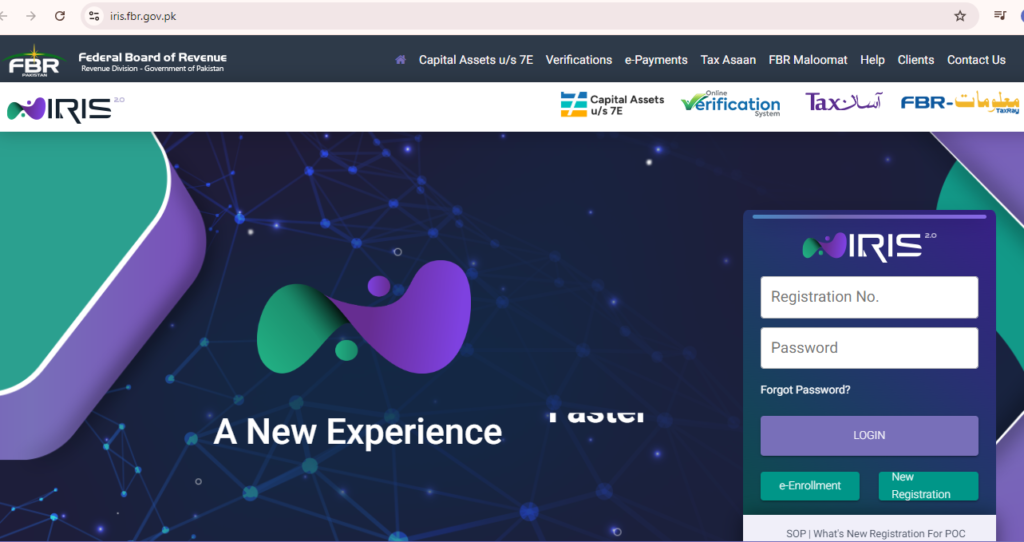

- Visit the FBR’s IRIS portal.

- Click on “Registration for Unregistered Person.”

- Fill in the required information and submit.

3. Filing Your Income Tax Return

Once you’ve gathered all the necessary documents and registered with FBR, you can proceed with filing your return.

3.1 Logging into the IRIS Portal

- Visit the IRIS portal.

- Enter your CNIC/NICOP and password to log in.

3.2 Filling Out the Income Tax Return Form

- Step 1: Select the tax year for which you are filing the return.

- Step 2: Choose the appropriate form based on your income type (Salaried, Business, etc.).

- Step 3: Fill in your personal details, income details, and any applicable tax credits.

- Step 4: Upload any required documents, such as your income statements and bank statements.

3.3 Submitting the Return

After filling out all the required information:

- Review the form for any errors or omissions.

- Click on “Submit” to file your return.

4. After Filing: What’s Next?

After filing your return, you may receive an acknowledgment from the FBR. Here’s what to do next:

4.1 Payment of Tax (If Applicable)

If your return shows a tax liability, you need to pay the tax through the following methods:

- Bank branches designated by the FBR.

4.2 Refunds and Adjustments

If you’ve overpaid taxes, you can claim a refund. The refund can be adjusted against future tax liabilities or claimed directly through the IRIS portal.

5. Important Deadlines and Penalties

Filing your tax return on time is crucial to avoid penalties.

5.1 Filing Deadlines

- For individuals: September 30th

- For businesses: December 31st

5.2 Penalties for Late Filing

Failure to file on time can result in penalties, including fines and possible legal action by the FBR.

Download Tax Law Amendment Act 2024 Pakistan.

Islamabad, the 6th May, 2024

No. F. 22(13)/2024-Legis.—The following Act of Majlis-e-Shoora

(Parliament) received the assent of the President on the 3rd May, 2024 is hereby

published for general information:—

ACT NO. V OF 2024

FAQs

Q1: Can I file my tax return without a tax consultant?

Yes, you can file your return independently using the FBR’s IRIS portal. However, if your tax situation is complex, consulting a tax professional is advisable.

Q2: What happens if I don’t file my income tax return?

Failure to file can result in penalties, including fines, legal action, and being blacklisted by the FBR, which could affect your ability to get loans or travel.

Q3: How can I check the status of my tax return?

You can check the status of your return and navigating to the “My Cases” section.

Q4: What should I do if I made a mistake in my return?

You can file a revised return within 60 days of the original submission by logging into the IRIS portal and selecting the option to revise the return.

Q5: Can non-resident Pakistanis file their tax returns online?

Yes, non-resident Pakistanis can file their returns online through the IRIS portal.

By following this guide, you’ll be able to file your income tax return in Pakistan with ease. For more information, visit the FBR website or consult a tax professional.